Pharmaceuticals & Cosmetics R&W - Transaction Multiples

Epsilon Research covers the M&A transactions for the "Pharmaceuticals & Cosmetics R&W" industry [79 EMAT Reports], which includes:

Our analysts publish transaction multiples reports for private company M&A deals (announced 2004 onwards).

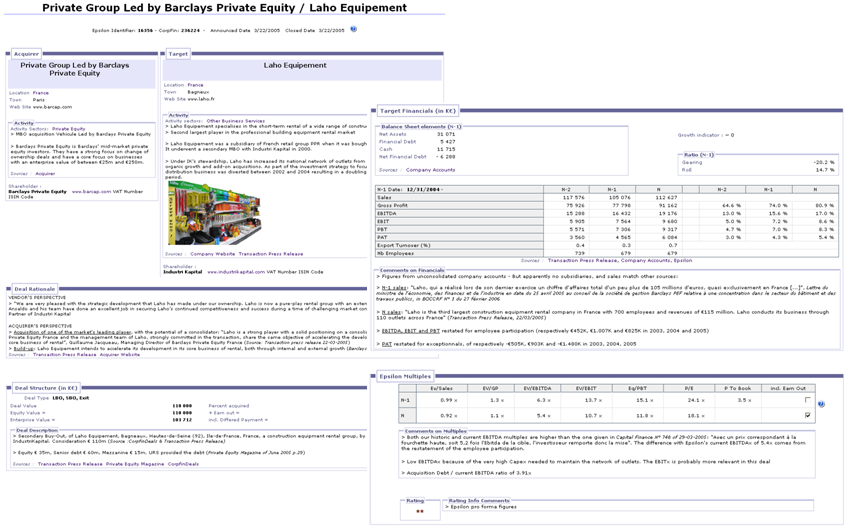

Each report presents detailed information on the deal value, structure and rationale, the target's activity, history and financial information; it includes the calculation of the key historic and current multiples: enterprise value over sales (EV/S), EBITDA (EV/EBITDA), or EBIT (EV/EBIT), P/E and Price to Book. All information sources are systematically given and company financials are carefully verified and restated if needed.

The reports are a unique source of information to have a comparable metric for the valuation of a private company, establish the "market value" of an investment or private equity investment portfolios.

The deal reports are published in Epsilon's EMAT database.

For an example of EMAT report, please click on this link.

If you wish to buy an EMAT Report, and you are not a customer, please contact us.

Recent M&A Deal Reports Published on EMAT

| Date | Acquirer | Target | Country | Industries | Valuation multiples | See details |

|---|---|---|---|---|---|---|

| 16/01/2024 | Private Group led by Ardian | Healthy Group (Aprium) | Hauts-De-Seine | Drugs Retailers | * | 119963 |

| 04/01/2024 | L'Occitane International | Dr. Vranjes Firenze | Italy | Personal Products, Cosmetics & Perfumes | ** | 115896 |

| 21/12/2023 | Groupe Laf Santé | Magdaléon | Bas-Rhin | Drugs Retailers | ** | 120860 |

| 01/11/2023 | Private Group backed by Arcola | Golden Naturals | Netherlands | e-commerce (B2C), Drugs Retailers, Food Complements | * | 117948 |

| 23/10/2023 | LloydsPharmacy Ireland | Kalamunda | Ireland | Drugs Retailers | * | 115321 |

| 06/07/2023 | Series B funding round backed by Nextstage AM | Mediprix | Hérault | Drugs Retailers | * | 113575 |

| 13/04/2023 | Groupe Laf Santé | Elsker Group | Nord | Drugs Retailers | * | 120884 |

| 21/11/2022 | UniPhar | BModesto | Netherlands | Drugs Retailers | ** | 110851 |

| 02/10/2022 | Boticinal | Ceido (Centre Européen d’Intérêt et de Développement de l’Officine) | Paris | Drugs Retailers | * | 111449 |

| 20/09/2022 | UniPhar | LXV Remedies Holdings (McCauley Pharmacy Group) | Ireland | Drugs Retailers | * | 110405 |

| 01/08/2022 | Private Group led by Literacy Capital | Ashleigh & Burnwood | England | Cosmetics & Perfumes | *** | 117337 |

| 02/07/2022 | Private Group led by Latour Capital | Groupe Laf Santé | Haute-Garonne | Drugs Retailers, Eyewear (retail) | * | 119979 |

| 06/03/2022 | Groupe Laf Santé | Gêner'+ (Pharmacorp) | Haute-Garonne | Drugs Retailers | * | 120898 |

| 02/12/2021 | Boticinal | Dynamis Santé | Bas-Rhin | Drugs Retailers | * | 111429 |

| 08/07/2021 | Colruyt Group | Newpharma | Belgium | e-commerce (B2C), Pharmaceuticals & Cosmetics R&W | ** | 108140 |

| 02/03/2021 | MHP DXB | Adam Myers | England | Drugs Retailers | ** | 110483 |

| 25/02/2021 | Private group led by Isatis Capital, BNP Paribas Développement | Sagitta Pharma (T&J Healthcare) | Indre-Et-Loire | Drugs Retailers | * | 107980 |

| 11/02/2021 | Private Group led by Nobel Capital Partners | Vitaminstore Online | Netherlands | e-commerce (B2C), Drugs Retailers | ** | 117940 |

| 26/11/2020 | Medios | Cranach Pharma | Germany | Drugs Retailers | ** | 110471 |

| 01/09/2020 | UniPhar | Hickey's Pharmacy Group | Ireland | Drugs Retailers | ** | 110427 |