Argos Index® mid-market

Evolution of Euro Zone Mid-Market Private Company Prices – Quarterly Index carried out by Epsilon Research

In partnership with:

Q3 2025: the Argos Index® down further to 8.7x EBITDA, the lowest level since 2017

Paris (France) – 20 November 2025 – The mid-market Argos Index® for the third quarter of 2025, published by Epsilon Research, the online platform for the management of unlisted M&A transactions, and Argos Wityu, the independent European investment fund, is now available. Launched in 2006, this index tracks the valuations of unlisted eurozone SMEs in which a majority stake has been acquired during the last six months.

In the third quarter of 2025, acquisition prices for European SMEs fell to 8.7x EBITDA, the lowest level since 2017. Despite solid fundamentals – subdued inflation, robust corporate earnings and optimism about AI – the increase in long-term interest rates and higher term premiums pushed down valuations. The tension in the market reflects uncertainties about growth, geopolitical risks and fiscal risks in Europe. In addition, tighter credit conditions in the eurozone, and particularly in Germany, limited the use of leverage, reducing buyers’ ability to make acquisitions and increasing the downward pressure on SME prices.

Acquisition prices for unlisted European SMEs fell sharply (-5.4%) to 8.7x EBITDA, the weakest level seen since the first quarter of 2017, i.e. the lowest for 8 years and 9 months.

Prices paid fell in both broad buyer segments, i.e. among strategic buyers and funds.

- In the third quarter of 2025, valuations continued to decline, with multiples paid by investment funds falling by 10% to 9.0x and those paid by strategic buyers down again to 7.7x, a historically low level.

- Fund exits increased by 12.5% during the quarter, encouraging sellers, and funds in particular, to adjust their price expectations. That adjustment contributed to a narrowing in the bid-ask spread, indicating greater convergence between buyers and sellers.

- The drop in the Argos Index® reflects this repricing process and is helping M&A activity to recover.

The proportion of transactions at multiples of less than 7x EBITDA continued to rise.

- In the third quarter of 2025, the proportion of transactions taking place at extremely low multiples, i.e. less than 7x EBITDA, increased to 28%. This highlights persistent downward pressure on valuations.

- Meanwhile, the proportion of transactions taking place at multiples of more than 15x EBITDA fell to an all-time low of 7%.

There was a limited recovery in eurozone mid-market M&A activity.

- After falling sharply in the first quarter of 2025, eurozone mid-market M&A began to recover in the second quarter (updated data) and then stabilised in the third.

- As a result, in the first nine months of the year, mid-market M&A activity in the eurozone was stable compared with the same period of 2024. It was 20% higher than the average level seen between 2020 and 2023. However, Europe is lagging behind the worldwide gradual recovery in M&A activity.

> You can download the full study under "Data Publication"

Argos Mid-Market Index

Evolution of the EV/EBITDA historic, 6 months rolling basis

Source: Epsilon Research / Mid-market Argos Index®

What do they think of the Index?

- Professor Reiner Braun, Technical University of Munich (March 2020)

- Éric de Montgolfier, CEO of Invest Europe (Dec. 2019)

“The Argos Index® is an important benchmark for valuing unlisted European companies and is based on very reliable data", Éric de Montgolfier, CEO of Invest Europe"

Data publication

Detailed Data on Euro Zone Multiples

Access underlying EMAT Reports

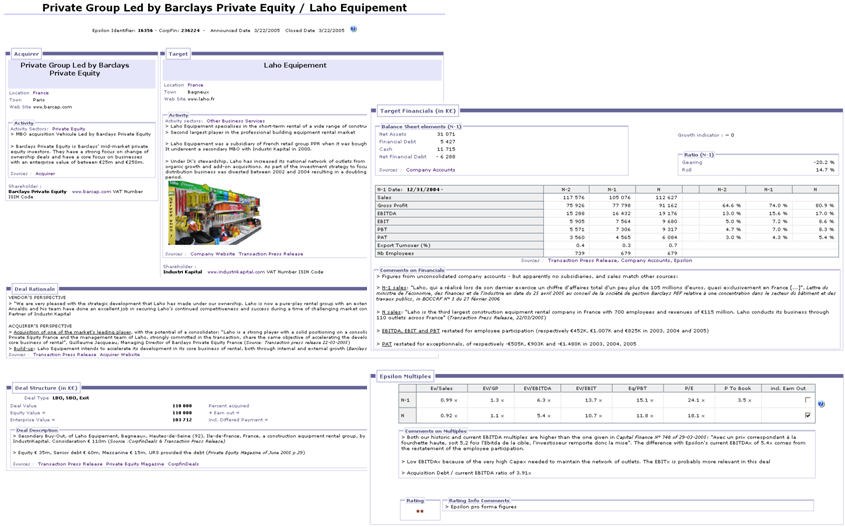

Index source of info

EMAT – Epsilon Multiple Analysis Tool™

The Reference Source for Private Company Acquisition Multiples

Test EMAT / SubscribeReceive the Index (free)

Register to receive the Index as soon as published

Argos - Previous Releases

×Example of Emat Report

×